Articles

Learn how to start and properly operate a business in Malaysia. These articles are also useful for new business owners.

Customer Testimonials

Hear what our valuable clients have to say about their experience with Bossboleh.

BB e-Learning School

Education should be accessible to all. This platform breaks barriers with curated video lessons at your fingertips.

Understanding Tax Penalties in Malaysia: A Comprehensive Guide

In Malaysia, the Inland Revenue Board (LHDN) enforces strict tax compliance to ensure the integrity of the national tax system. Non-compliance with tax obligations can lead to significant penalties, including fines, imprisonment, or both. This guide outlines the various tax offences and corresponding penalties to help taxpayers stay informed and compliant.

1. Failure to Furnish Income Tax Return

Taxpayers are required to submit their Income Tax Return Forms (ITRF) annually. Failure to do so can result in:

- A fine between RM200 and RM20,000, or imprisonment up to six months, or both.

- For repeated offences, the penalty increases to a fine between RM1,000 and RM20,000, or imprisonment up to three years, or both, along with a penalty of 300% of the tax payable.

2. Late Payment of Taxes

Timely payment of taxes is crucial. Late payments attract the following penalties:

- A 10% penalty on the unpaid tax amount after the due date.

- An additional 5% penalty if the tax remains unpaid 60 days after the initial penalty.

3. Incorrect Tax Returns

Submitting incorrect tax returns, whether by omitting income or providing false information, is a serious offence:

4. Wilful Tax Evasion

Deliberate attempts to evade tax obligations are met with severe penalties:

- A fine between RM1,000 and RM20,000, or imprisonment up to three years, or both.

- An additional penalty of 300% of the tax undercharged.

5. Assisting in Tax Evasion

Assisting others in evading taxes is equally punishable:

- A fine between RM1,000 and RM20,000, or imprisonment up to three years, or both.

- A penalty of 300% of the tax undercharged.

6. Obstructing Tax Officers and Poor Record-Keeping

Obstructing LHDN officers or failing to maintain proper records can lead to:

- A fine up to RM10,000, or imprisonment up to one year, or both.

7. Underestimation of Tax Estimates

Underestimating tax payable by more than 30% can result in:

8. Failure to Furnish Country-by-Country Report (CbCR)

For multinational entities, not submitting the CbCR can incur:

Appealing Tax Penalties

If you believe a penalty has been wrongly imposed:

- Submit a written appeal to the LHDN within 30 days of receiving the notice.

- Use Form Q for the appeal and provide all necessary supporting documents.

- If the appeal period has lapsed, apply for an extension using Form N, stating valid reasons for the delay.

Conclusion

Understanding and adhering to tax obligations is essential to avoid penalties. Staying informed about tax laws and deadlines ensures compliance and contributes to the nation’s development. For more detailed information, visit the LHDN official website.

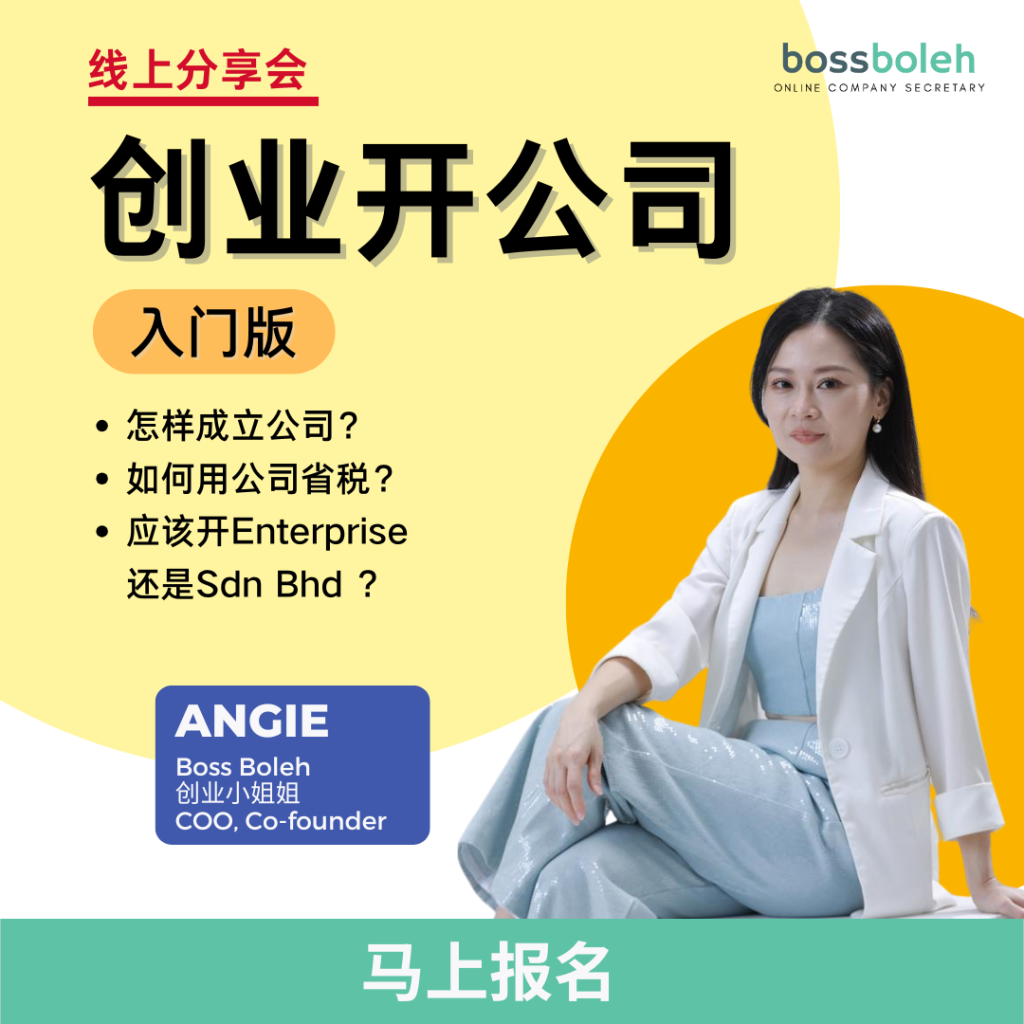

Want to learn more about managing your business structure the right way? 💼

Join our FREE webinar! We’ll walk you through compliance essentials and how to convert from Enterprise to Sdn Bhd with confidence.

For more details, feel free to WhatsApp us!

📲 WhatsApp: 018-7678055